Budget

Where are our tax $$$ going?

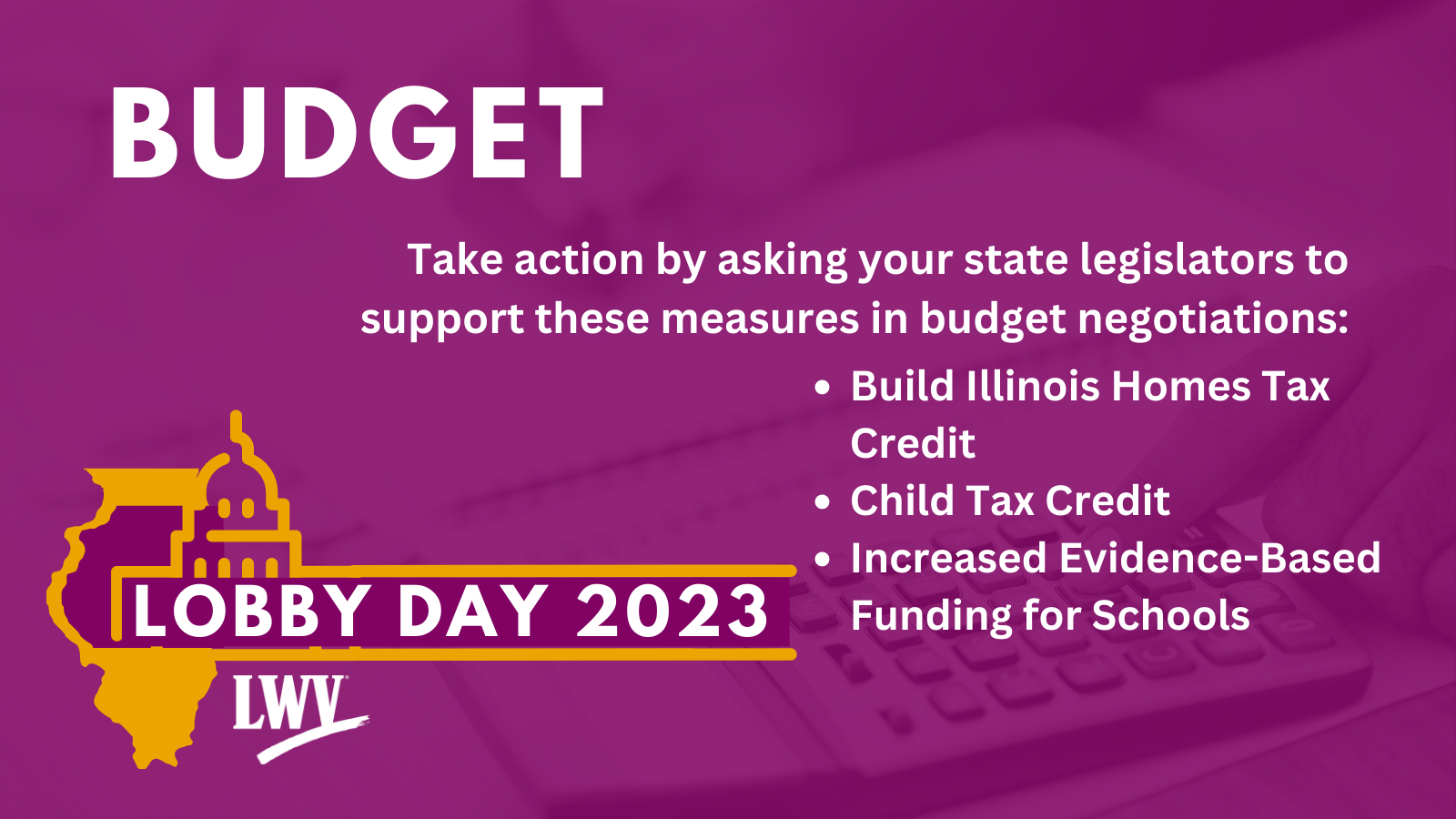

It’s time to set the Illinois state budget for 2023–24. Contact your state senator and state representative, and ask them to support the following measures in budget negotiations:

Build Illinois Homes Tax Credit

Child Tax Credit

Increased Evidence-Based Funding for Schools

Also ask your state legislators to OPPOSE using public tax dollars to fund private schools.

Give it five minutes

Call or email each of your your state legislators: “I am contacting you on the League of Women Voters of Illinois Lobby Day to tell you that the League supports the Build Illinois Homes Tax Credit, Child Tax Credit, and Increased Evidence-Based Funding for Schools. I am your constituent, and during budget negotiations I want you to support funding a more equitable Illinois! Please support the Build Illinois Homes Tax Credit, Child Tax Credit, and Increased Evidence-Based Funding for Schools.

The League also opposes using public tax dollars to fund private schools. As your constituent, I ask that you do the same. Please do not extend the Invest in Kids program in the budget. Do not establish Education Savings Accounts.”

Give it more time

Activate your networks

Encourage friends to contact their state legislators by using these graphics for social media, emails, and texts.

Suggested copy:

Where are our tax $$ going? Budget negotiations are coming up—ask your state legislators to support measures that will improve the lives of all Illinoisans. Learn more: lwvil.org/lobbyday23 #LobbyDayLWVIL

Stop by your state legislator’s HOME Office

Drop in! Without an appointment, you might not be able to see your legislator, but you can drop off fact sheets (find them below) and maybe talk to a staffer.

Budget measures to SUPPORT

Build Illinois Homes Tax Credit

Provides that owners of qualified low-income housing developments are eligible for credits against the taxes imposed by the Illinois Income Tax Act or taxes, penalties, fees, charges, and payments imposed by the Illinois Insurance Code.

Background: Illinois lacks sufficient affordable housing There are more than 450,000 extremely low-income renters in Illinois, with a deficit of more than 288,000 affordable and available rental units for them Without proper affordable housing, Illinoisans lose out: our tax base is smaller, our population shrinks when businesses are discouraged from expanding here, and our health care and other costs of housing insecurity grow.

League Position: The State should plan for adequate supplies of low and moderate-income housing. Until the Illinois Constitution is amended to allow graduated rates, the flat rate income tax should be made more progressive.

Child Tax Credit

Eligible low- and middle-income Illinois families would receive a tax credit for each child under the age of 17.

Background: The federal child tax credit, before it ended this year, lifted millions of children out of poverty. Studies showed that parents spent the additional dollars on food, school supplies, clothing, and other necessities for their children. A refundable state child tax credit would help replace some of the dollars that Congress took away, and help low income families care for their children. This would help half of the children in Illinois.

League Position: The most effective social programs are those designed to prevent or reduce poverty. Persons who are unable to work, whose earnings are inadequate, or for whom jobs are not available have the right to an income and/or services sufficient to meet their basic needs for food, shelter, and access to health care. LWVIL supports secondary state funding for income assistance and supportive services for all low-income individuals and families.

Increased Evidence-Based Funding for Schools

Provide that the Minimum Funding Level for Evidence-based funding of education is equal to $550,000,000 (instead of $350,000,000).

Background: Evidence-Based Funding (EBF) is closing Illinois’ drastic funding and achievement gaps between schools in property-rich and property-poor districts, as well as between schools in predominantly white communities and schools that serve predominantly students of color. But still over 1.2 million students in Illinois attend schools that are funded at less than 80% needed for an adequate education.

See the gap to adequate funding for schools in your legislators’ districts

League Position: Pre-Kindergarten through 12th grade public schools should be provided stable, reliable and adequate revenue through a combination of federal, state and local sources.

Budget measure to OPPOSE

Using public money to fund private schools

The “Invest in Kids” Act is a tax credit scholarship program which offers a 75 percent income tax credit to individuals and businesses that contribute to qualified Scholarship Granting Organizations (SGOs). The SGOs then provide scholarships for students whose families meet the income requirements to attend qualified, non-public schools and technical academies in Illinois

Another school funding proposal that might be included in budget negotiations is “Education Savings Accounts,” which would send a share of state appropriations for a public school directly to parents in that district who agree not to attend the public school. It would create another program with no accountability or oversight over the quality of a child's education or use of public dollars, and reduce funding for public schools.

Ask your Legislators to oppose diverting public education dollars to private schools. Do not extend the Invest in Kids program in the budget. Do not establish Education Savings Accounts.

Background: The euphemistically-named “Invest in Kids” Act was a compromise measure when Evidence-Based Funding was first passed, and was designed to sunset automatically. Individual donors may contribute up to $1 million and receive a 75% tax credit against the state income taxes they owe. It diverts up to $75 million in tax dollars from public schools to private schools at a time when 80% of public schools in Illinois are not adequately funded. It gives the appearance of helping low-income students, but only about 9000 students receive scholarships, while the state fails to provide adequate funding for the public schools attended by over 800,000 low income children. Further, there is a lack of transparency and accountability about how the funds are being used. Many of the private schools receiving state money discriminate against children with special needs, LGBTQ identity, or different religious beliefs. 94% of the participating private schools are religiously affiliated.

League Position: The League opposes proposals that would provide public funds for private schools.